In Nigeria, getting access to quick and reliable loans can be challenging, especially for students who need financial support to pay tuition fees, buy books, or cover living expenses. With the growing popularity of fintech platforms like Moniepoint Microfinance Bank (MFB), many students are asking:

👉 Does Moniepoint MFB give loans to students?

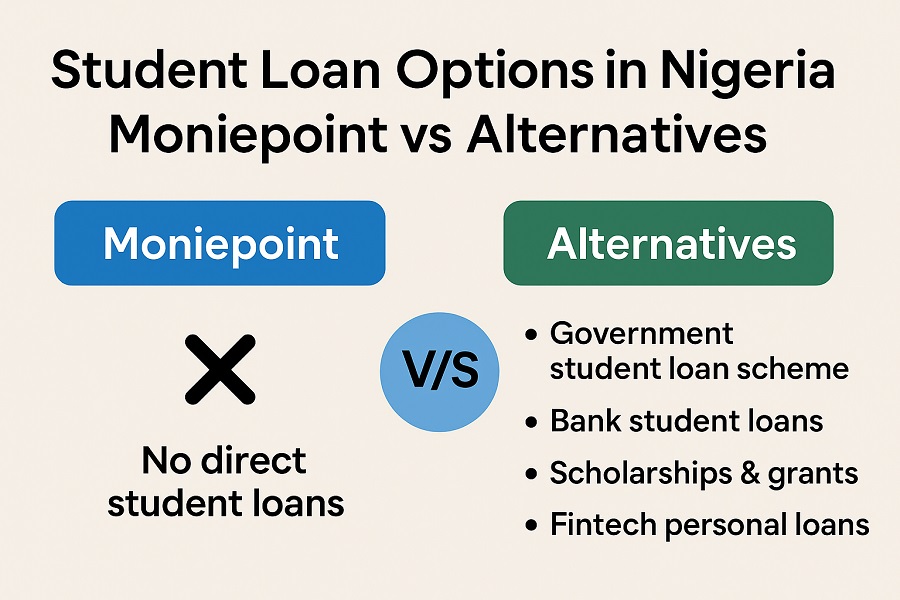

The short answer is: Moniepoint MFB currently does not directly offer student loans. Instead, its loan products are mainly designed for business owners, agents, and entrepreneurs. However, this doesn’t mean students are completely excluded from financial help. Let’s break it down.

What is Moniepoint MFB?

Moniepoint Microfinance Bank (licensed by the Central Bank of Nigeria and insured by NDIC) is one of Nigeria’s fastest-growing digital banks. It is best known for:

-

Providing POS terminals and agency banking services.

-

Offering business loans to small and medium enterprises (SMEs).

-

Running a secure mobile banking app for savings, transfers, and bill payments.

Because of its structure, Moniepoint’s primary focus is business support, not student financing.

Does Moniepoint MFB Offer Student Loans?

At the moment:

-

Moniepoint does not have a dedicated student loan product.

-

Loan facilities are tied to business performance, transactions, and repayment ability.

-

Students who do not operate a registered business or Moniepoint POS outlet are not eligible.

So, if you’re a student looking to borrow directly from Moniepoint, the answer is no — unless you run a business under their system.

Who Can Get a Moniepoint Loan?

Moniepoint loans are mainly available to:

-

Registered agents (POS operators).

-

Business owners using Moniepoint accounts actively.

-

Merchants with consistent transactions and repayment history.

These loans are business-based, not academic-based.

Why Doesn’t Moniepoint Offer Student Loans?

There are a few reasons:

-

Risk factor: Students often lack steady income streams to guarantee repayment.

-

Business model: Moniepoint is built around supporting entrepreneurs and SMEs.

-

Regulatory restrictions: Student loans often require special government-backed programs, not just private lenders.

Alternatives for Students Who Need Loans

Even though Moniepoint does not provide direct student loans, there are other reliable options in Nigeria:

1. Government Student Loan Scheme

The Nigerian Student Loan Act (2023) now provides interest-free loans to students in public institutions through the Education Loan Fund.

2. Commercial Bank Student Loans

Some banks like GTBank, Access Bank, and First Bank have tailored student-friendly loan products for tuition fees and academic support.

3. Scholarships & Grants

Many NGOs, state governments, and international bodies offer financial aid that doesn’t need repayment.

4. Fintech Alternatives

Platforms like Carbon, FairMoney, and Branch may provide personal loans that students can apply for if they meet requirements.

Can Students Indirectly Access Moniepoint Loans?

Yes — if you are a student who also:

-

Runs a registered POS business with Moniepoint.

-

Has a verifiable business account with steady transactions.

In such cases, you may qualify for Moniepoint’s business loans, but it won’t be categorized as a “student loan.”

Pros and Cons of Using Moniepoint as a Student

| Pros | Cons |

|---|---|

| Secure, licensed bank | No direct student loan product |

| Business loans have flexible repayment | Requires business ownership/transactions |

| User-friendly mobile app | Focused more on SMEs than individuals |

FAQs

1. Does Moniepoint give student loans for tuition fees?

No, Moniepoint does not currently provide loans for school fees.

2. Can I apply for a Moniepoint loan as a student?

Only if you run a registered business with them.

3. What is the minimum requirement for a Moniepoint loan?

Consistent transactions through your Moniepoint account and a good repayment history.

4. Are there better student loan options in Nigeria?

Yes, the new Federal Government Education Loan Scheme is one of the best options.

Conclusion

While Moniepoint MFB does not currently give loans to students, it remains one of the strongest platforms for business financing in Nigeria. For students, the best alternatives include the new government-backed student loan scheme, bank loans, scholarships, and fintech personal loans.

👉 If you are a student entrepreneur, you can still benefit from Moniepoint loans by operating a business through their platform.

Final Tip: Always confirm loan eligibility, repayment terms, and interest rates before applying.